are delinquent taxes public record

507 Vermont St Suite G12 Quincy IL 62301. Have not paid their taxes for at least 6 months from the day their.

Tax Collections Cabarrus County

Please Call the Delinquent Tax Office at 843 665-3095 to verify tax amount due prior to payment.

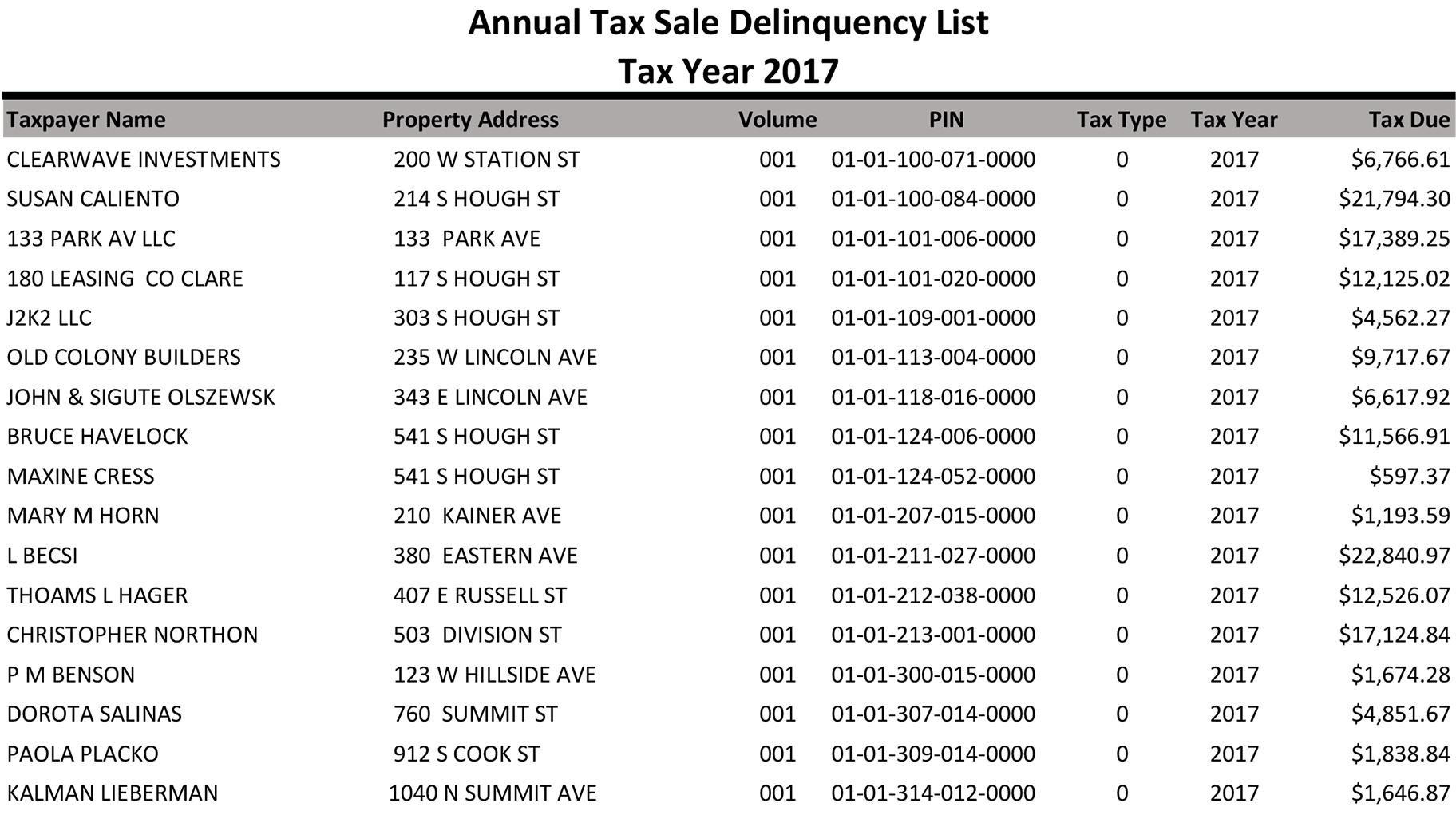

. Public Record Delinquent Real Estate Tax Listing. Page Last Reviewed or Updated. Information on property tax calculations and delinquent tax collection rates.

Each month we publish lists of the top 250 individual and business tax debtors with outstanding tax warrants. Tax Extension and Rates The Clerks Tax Extension Unit is. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000.

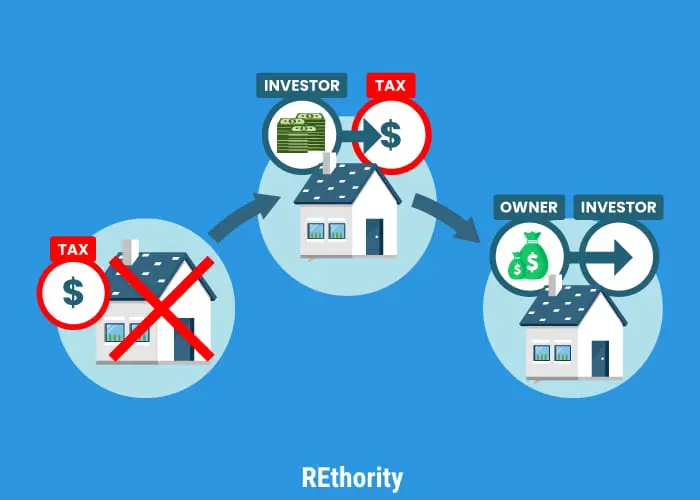

Official Tax Rates Exemptions for each year. Typically a tax lien is placed on the property by the government when the owner fails to pay the property. Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on.

New York State delinquent taxpayers. We will issue a tax lien release once your Unsecured Property Tax Bill is paid in full. All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions.

We may have filed the. Phone 217277-2245 Fax 217277-2000. Access to Public Records Public records access is a part of Westmoreland Countys ongoing effort to provide easy and enhanced delivery of county information and services.

The Wayne County Treasurers Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. The Tax Office accepts full and partial payment of property taxes online. Notice of Delinquency - The Notice of Delinquency in accordance with California Revenue and Taxation Code Section 2621 reminds taxpayers that their property taxes are delinquent and.

If you have paid your bill in full and have not received your tax lien release you may contact us at. Property Info Taxes. Delinquent Property Tax Search When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with.

Tax Redemption If your unpaid taxes have been sold the Clerks office can provide you with an Estimate of the Cost of Redemption. Return to the IRS Data Book home page. Effective September 1998 all payments on delinquent taxes must be made in.

Property taxes not paid to the. Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. Delinquent tax records are handled differently by state.

The tax certificates face amount consists of the sum of the following. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount.

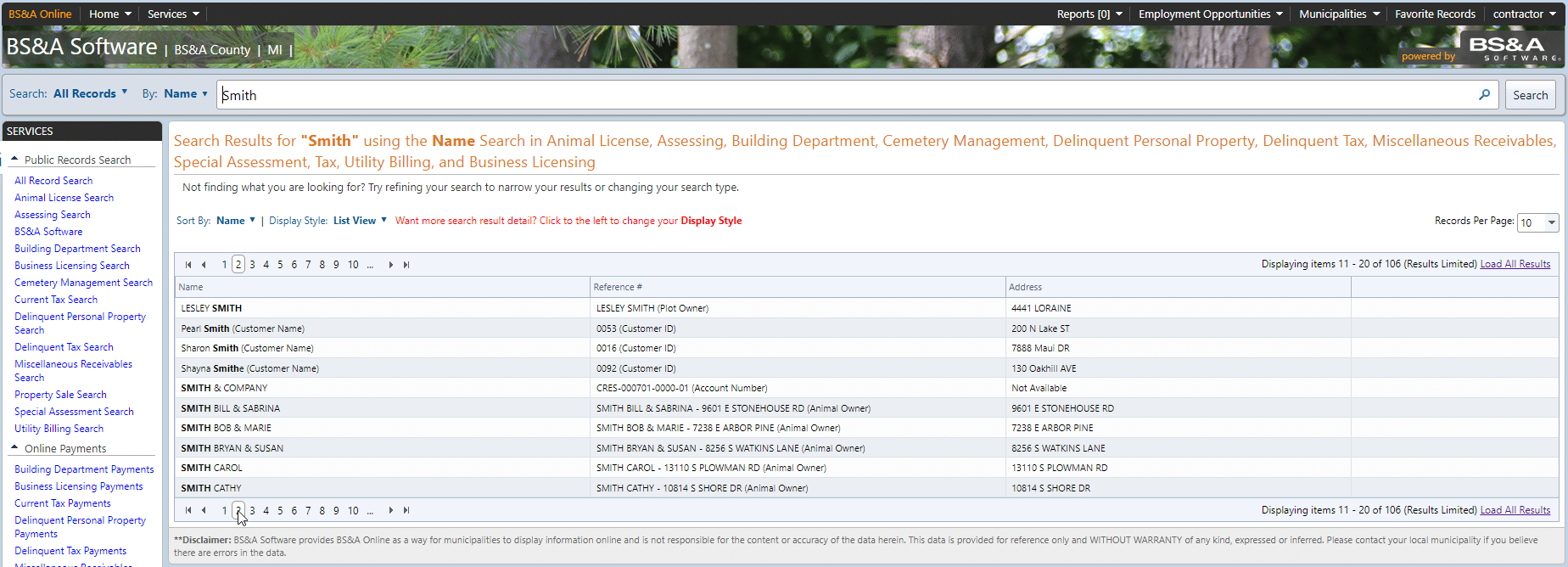

Bs A Online Services Public Records Search Bs A Software

Delinquent Tax Sale Set For August 29 Tate Record

How To Find Tax Delinquent Properties In Your Area Rethority

Sandusky County Ohio Treasurer

Real Estate Property Tax Constitutional Tax Collector

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

More Than 12 000 Tax Delinquent Properties In Arkansas Set To Head To The Auction Block Katv

Tax Lien Certificates Vs Tax Deeds What S The Difference Proplogix

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

How To Find Tax Delinquent Properties In Your Area Rethority

Tax Deeds St Johns County Clerk Of Court

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

5 Ways How To Find Tax Delinquent Properties In Your Area Find Houses With Tax Liens Free